Writing checks isn’t as common as it used to be. Many of us rely on our credit cards, direct debit and cash to make the payments in our lives. For some people, a monthly rent check is the only check they ever write. But whether you’re setting up direct deposit, online bill pay or a money transfer account, you’ll still need to know where to find your account number and your bank’s routing number.

What’s the Difference Between the Routing Number and Account Number?

A routing number, or bank transit number, is a nine-digit number that helps banking or other financial institutions know where a financial document, such as a check, originated from. It identifies the bank that money will typically be flowing in or out of when a transaction is complete.

An account number is a unique number that identifies an individual or legal entity’s bank account. Every account number is unique at the financial institution, or routing number, that it is associated with. This ensures that every financial account in the world has a unique combination of routing and account numbers to always be correctly identified.

How to Find Your Account Number on a Check

If you have a personal or business check in front of you, you’re looking at your account number even if you don’t know it. So where is the account number on a check?

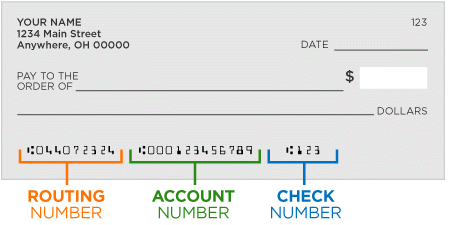

Your account number is the long string of numbers that’s in the middle of the bottom of your check. Check out our graphic below if you’re in doubt. The account number on a check could be in a different spot depending on your bank, but chances are the account number on your check will be where it is in our diagram.

You might need to find the checking account number on your check if someone has asked you for your account number because that person wants to give you some money. Or perhaps maybe you need the account number to set up direct deposit for your paycheck at work. Knowing where to find your bank account number on your checks can come in handy. The fact that the account number appears on each of your checks in an easy-to-find location is a good reason to keep your checkbook safe and secure.

How to Find Your Routing Number on a Check

Until you’re asked to supply it, you may not know what routing numbers are or how many digits are in a routing number. A routing number is usually specific to the state where you opened your bank account. Some banks have different routing numbers for different kinds of transactions. For example, the routing number for your bank in your state might be different depending on whether it’s for electronic payments, wire transfers or ordering checks.

What does a routing number mean? Think of it as an identifier for your bank. ABA routing numbers, routing numbers assigned to banks by the American Bankers Association, have nine digits.

If you log on to your bank’s website, you should be able to find your bank’s routing number in no time. It’s a common question. Bank routing numbers are important for sending money back and forth between banks. And if you want to close a bank account and transferfunds from your old bank to a new bank, you’ll need that routing number.

Bottom Line

Now that you know how to find the account and routing numbers on a check, you’ll be prepared the next time you need either number to complete a financial transaction. If you have any doubt about which checking account routing number to use for a given transaction, you can always call your bank and check with a representative.

And if you’re looking for your check number, it’ll be the one in the top right corner or the last number on the right, in the same row as the account and routing numbers. Check out the diagram above if you have any lingering doubts.

Tips for Managing Your Finances

- Savings and investments can be a lot to figure it out. To ensure your financial plan is in good shape, it might be worth speaking to a financial advisor to help you sort it out and to answer your questions.Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Savings account interest rates are a constantly changing environment. So try to keep tabs on where the market is if you want to maximize your savings potential. To help you get started, check out SmartAsset’s list of the best savings accounts on the market.

Photo credit:©iStock.com/Oddphoto,©iStock.com/Oddphoto

FAQs

Find the routing and account numbers on a check. What are the numbers on a check? At the bottom of a check, you will see three groups of numbers. The first group is your routing number, the second is your account number and the third is your check number.

Do all checks have routing and account numbers? ›

Every check that's printed at the same bank in the same state will have the same routing number in the MICR line. The third number in the MICR line is the check number in that checkbook for that account. This number should be identical to the check number printed in the check's top right-hand corner.

Which number is the account number on a check? ›

Your account number (usually 10 digits) is specific to your personal account. It's the second set of numbers printed on the bottom of your checks, just to the right of the bank routing number.

Is micr my account number? ›

Is the MICR code the same as the bank account number? No, the MICR code is typically different from the bank account number. The MICR code includes the bank account number, cheque number, and bank code, while the bank account number is a unique identification number assigned to a specific bank account.

How many digits is a checking account number? ›

Bank account numbers typically consist of eight to 12 digits, but some account numbers could even contain up to 17 digits.

How do I find my routing and accounting number on a check? ›

At the bottom of a check, you will see three groups of numbers. The first group is your routing number, the second is your account number and the third is your check number.

Is MICR the same as routing number? ›

Routing Number: The routing number consists of nine digits printed on the bottom-left corner of your check. The odd font used to print the number is known as magnetic ink character recognition (MICR) and is printed in electronic ink to allow banking institutions to easily process checks.

Where is the account number not on a check? ›

Find Your Account Number on a Bank Statement

Typically, account numbers are provided in paper bank statements and electronic statements. If you have elected to receive electronic bank statements, you may have access to them online under Statements and Notices.

Should a routing number have a dash? ›

For US/Australian merchants: The routing and account numbers should not have any hyphens or extra characters added. They should just be numbers.

Do you include the zeros as a check number? ›

If you notice extra zeroes before or after your account number, please include them as part of your account number. It can be up to 17 positions in length and contains only digits and hypens. (A hyphen looks like this when it appears on a check.)

How To Find Your Account Number

- Look at Paper Checks. ...

- Review Bank Account Documents. ...

- Check Your Bank's Website or Mobile App. ...

- Ask Your Financial Institution.

Magnetic ink character recognition is the string of characters at the bottom left of a personal check that includes the account, routing, and check numbers. MICR numbers are designed to be readable by both individuals and sorting equipment. They can't be faked or copied, due to the use of magnetic ink and unique fonts.

What is the MICR code on a check? ›

MICR stands for Magnetic Ink Character Recognition – an important code in bank transactions. MICR Code is a unique 9-digit code that helps identify banks and its branches. This code is typically imprinted on cheque leaves and bank passbooks.

How do I find my 16 digit account number? ›

Every cheque leaf also has the account number printed on it. Passbook or Monthly Statements : Passbook: most public sector banks still provide a passbook which comprises all the debits and credits of the bank account.

What is the difference between a routing number and an account number? ›

While the routing number identifies the financial institution's name, the account number—usually between eight and 12 digits—identifies your account. If you hold two accounts at the same bank, the routing numbers will usually be the same, but your account numbers will be different.

How to search bank account number? ›

Internet Banking: For bank account number search, log in to the net banking portal of your bank. The Bank account number will be there on the homepage of your net banking portal. Passbook: The passbook that you get from a bank, is another place where you can find your bank account number.

Does every checking account have a routing number? ›

Each bank has at least one routing number, although larger banks can have more. At a bank with multiple routing numbers, they can change depending on the location where you opened your account and the type of transaction you're making.

What is the difference between a bank account number and a routing number? ›

Routing vs Account Number

A routing number is nine digits that identify the financial institution that holds your account, while an account number is the unique 9 to 12 digit number that identifies your specific account within that financial institution.

Can someone use my routing number and account number on a check? ›

But if these numbers get into the wrong hands, you could fall victim to severe financial fraud. If someone has your bank account and routing number, they could make unauthorized ACH transfers and payments, create counterfeit checks and even launder money through your account.

Which bank has a 9 digit account number? ›

When you start an account with Indian Bank, you will be given a 9-digit account number. Account numbers are assigned at random since Indian Bank employs BaNCS core banking.